In rural Nigeria, necessary investments in agriculture are inadequate, as farmers and agri-based entrepreneurs who engage in profitable agricultural activities yet lack access to financial services that meet their specific needs.

Especially in rural areas, women are financially excluded to a larger extent. Only 24% of women have a bank account compared to 54% of men (EFinA 2019). Despite 4 out of 10 business owners in Nigeria being women, women businesses remain stuck at the micro-level, facing significant barriers to sustainable growth (PwC 2020).

This situation is exacerbated in the predominantly Muslim North, which is characterized by a lack of banking infrastructure and financial literacy among farmers and agri-businesses. In addition, socio-cultural practices confine women to the home and household roles, and economic and particularly financial decisions are often the prerogative of husbands or other male relatives. Relatedly, contacts between women and non-related men are connoted as negative, even dishonourable, embodied e. g. in purdah*. This constrains women from accessing financial services which are mostly delivered by male staff.

Financing farmers and processors in the rice value chain

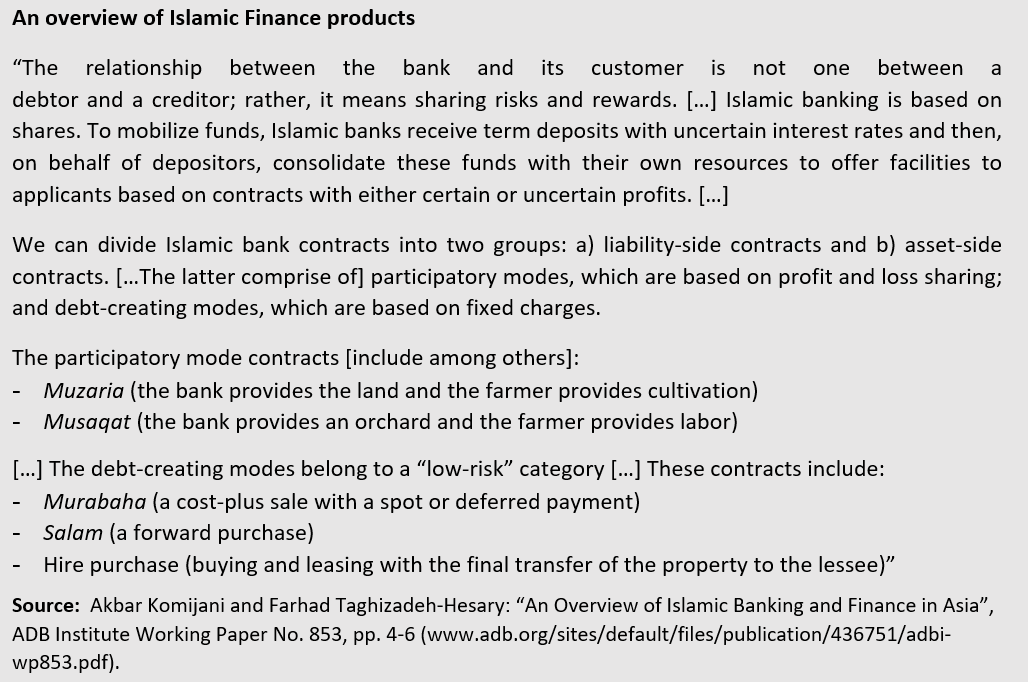

In response to these factors, AFC opted to work with Shari’a-compliant financial products that comply with Islamic law (Shari’a). Options explored include Ijarah – akin to leasing – and Murabaha; the latter became operational.

AFC provided technical assistance (TA) to a partner bank which had decided to provide agricultural finance to farmers and processing businesses in the rice value chain**. Most of these small processing businesses are operated by women (read our article). To ensure proper implementation and risk management, staff of the partner bank was trained in agricultural financial product design. For example, financing farmers and processors needs to be aligned with their cash flows. While input financing for farmers follows a balloon structure, processors repay per quarter. The bank decided to adjust the cost-plus financing scheme Murabaha for agricultural clients, both farmers and processors.

“AFC’s support and training in developing the Murabaha product for agriculturalists has been impactful for our bank: We reduced the approval process and time for agricultural facilities. Our staff now successfully negotiates with input suppliers, which greatly reduces the cost of production. E.g. rice farmers under Murabaha save between 10 and 14% - fixed profit of our bank included – compared to buying seeds on the open market.”

Abubankara Makinta, Head – Agricultural Finance at Jaiz Bank Plc, Nigeria, Feb. 2020

What is Murabaha and how does it work?

Conventional loans do not comply with Islamic law. Murabaha is an Islamic contract which is signed by the bank and the farmer/processor and which defines an operational fee (instead of an interest rate) plus the price of the good. The bank pays the input seller that distributes the input directly to the farmers/processors in exchange for allowing the client to defer payment. After a predefined time, the farmer/processor repays the bank.

The product was launched for rice farmers in March 2020 in Kano State and was expanded to women rice processors in January 2021. In the first round, 132 processors were financed. The repayment rate was 100%, and the bank subsequently expanded the number of Murabaha financing contracts given out. Furthermore, it introduced the product in an additional federal state, i.e. Kebbi in 2022.

Source: GIZ: “GIZ AgFin: Islamic finance for smallholders and agri-based enterprises in rural Nigeria”, video produced in the frame of the global project promotion of agricultural finance for agri-based enterprises in rural areas (AgFin), https://www.youtube.com/watch?v=5gX8fpvcGtg, 2021.

Effects of the new product

Prior to accessing financing, farmers and processors are trained on Famers’ Financial Cycle (FFC). They develop a savings plan, learn to keep records and understand what it takes to borrow and repay a loan. The women have benefitted greatly from the financial product. Their business activities have expanded, they employ more staff and contribute to their families’ livelihood.

Once processors continue to repay the facilities reliably, the bank will be able to finance higher amounts for working capital and equipment.

For further information, please contact Oliver.Schmidt [at] afci.de.

*Practice that was inaugurated by Muslims that involves the seclusion of women from public observation by means of concealing clothing (including the veil) and by the use of high-walled enclosures, screens, and curtains within the home (https://www.britannica.com/topic/purdah 22/11/21).

**Between 2019 and 2022, AFC implemented the country package Nigeria for GIZ’s Global Project ‘Promotion of agricultural finance for agri-based enterprises in rural areas’ (https://www.giz.de/en/worldwide/42696.html).