Equal access and opportunity for women and men is a well-documented success factor of any development intervention. Thus, the “gender-lens” is an important perspective AFC aims to apply in all of its projects, by asking ourselves: how do we contribute to reducing gender-imbalances in finance and how do we avoid deepening gender-imbalances.

In our project “Improving MSME Access to Finance”, for example, which we successfully implemented on behalf of GIZ in Ghana, from September 2020 until December 2022, we applied the gender-lens at the level of i) selecting partner organisations, ii) participation in our trainings and financial services, and at iii) the level of creating additional opportunity for female entrepreneurs.

Selection of partner organisations

The gender policy of the financial service providers (FSPs) was one of the criteria in the project’s selection of partner FSPs.

Our local AFC experts selected, among others, Access Bank as partner FSP, as it is particularly strong in its women-orientation. The Access Bank W-Initiative focuses on covering women customers’ personal and business loans by way of offering products targeted at the support of different women groups. These are i) unmarried women entering the corporate world; ii) wives who are offered products and services for family needs, to provide a one-stop-shop for family finance; and iii) women-owned MSMEs— who are supported in growing their businesses. The bank further promotes women entrepreneurship through the Women Entrepreneurs Pitch-a-ton conducted annually. AFC supported this initiative’s “mini-MBA” programme financially and also via a series of 10 training modules for 50 female entrepreneurs (learn more about AFC’s involvement here).

In addition, the partner FSP Sinapi Aba, is notable in its support for women, with over 82% of its loan portfolio dedicated to women borrowers and gender policies in place.

In its selection of trade associations, the project has worked, among other, with two associations with a high proportion of women-led members, namely GCFDA (70%) and GNTDA (80%).

Equal access of both genders to our trainings and financial products

Jointly with the five project partner FSPs, our team of experts adapted and developed nine innovative financial products, including three insurance products, specifically tailored to the needs of MSMEs. 55% of signed contracts were with women-led MSMEs.

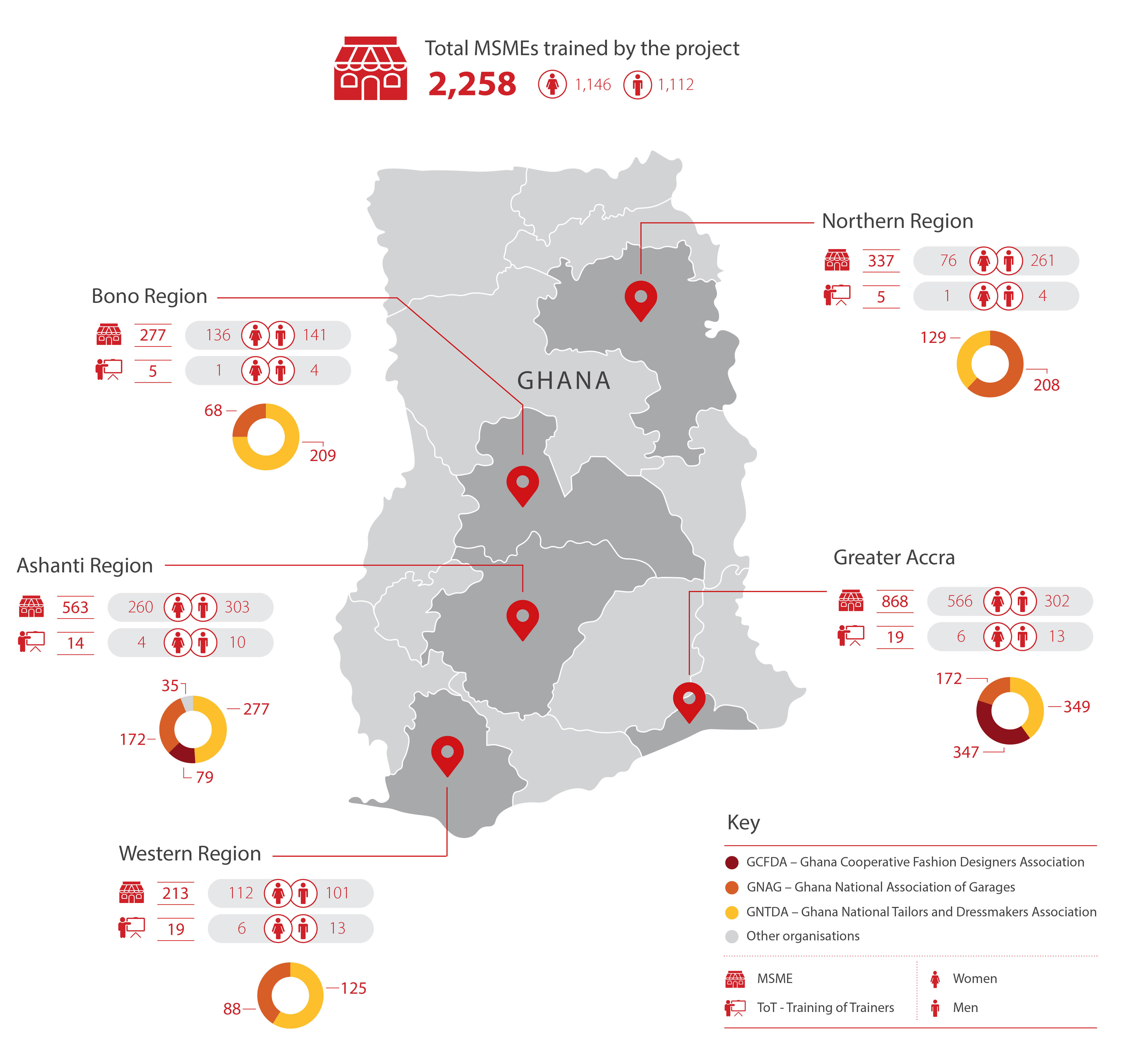

Moreover, 51% of the MSMEs we trained in “Financial Management and Access to Finance” were female entrepreneurs. The map below indicates the distribution per region.

For further information, please contact: Oliver.Schmidt [at] afci.de