AFC Agriculture and Finance Consultants (AFC) joined the 23rd Microfinance Centre (MFC) Annual Conference with the theme, “Social Finance Vibe: Pandemic Reboot” in Ukraine on 16 September 2021, an event which gathered online development bankers and financial sector professionals from all over the world to network, share ideas, and build the groundwork for successful future partnerships.

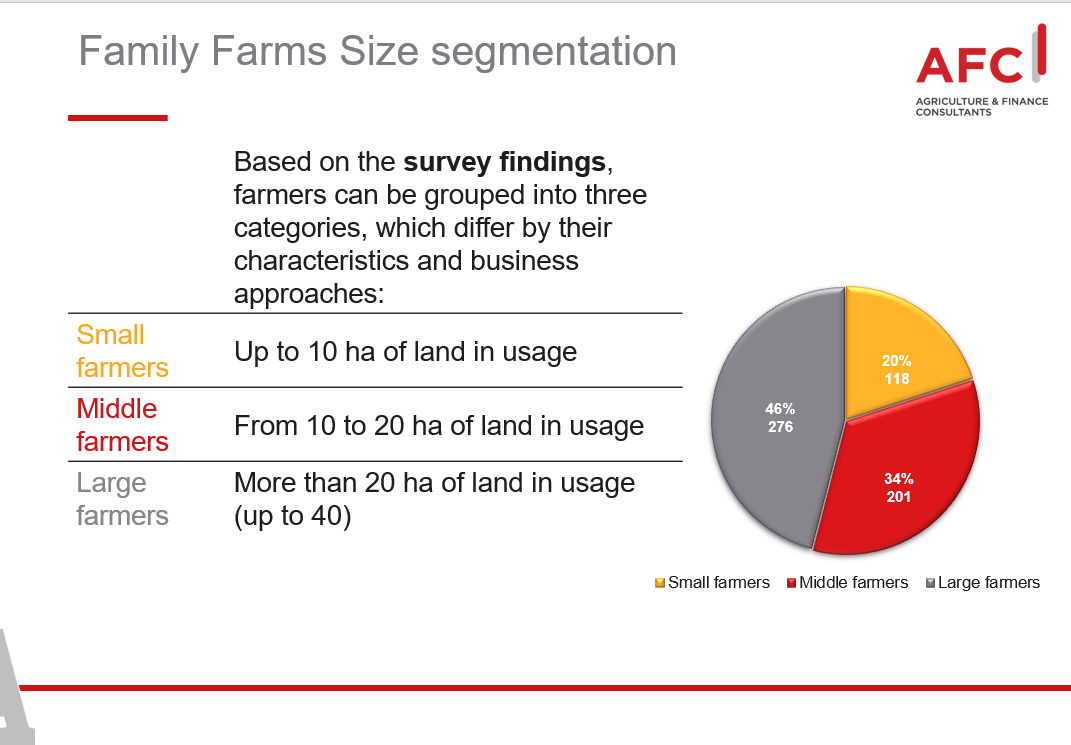

Dirk Felske, Team Leader of the ENTAFI Project which AFC implements on behalf of the European Investment Bank (EIB) in Georgia, Moldova, and Ukraine, presented the research results of the study, “Small Farms in Ukraine and their Access to Agricultural Finance” and highlighted that activities of farmers and their demand for credit significantly depend on the size of their business, geographic location, and access to water.

While developing the research, the AFC experts interviewed more than 600 farmers across the country, covered regional profiles of small farms in the entire Ukraine, developed the data analysis procedures, and provided recommendations, which can help Ukrainian financial institutions to tailor their products to the demand for financial services coming from small and middle farmers.

During interviews, many family farms in Ukraine revealed that the actual land in use by small and especially middle-sized farms is larger than officially stated:

The reason is that quite often family farms use land for business purposes without registering it (e.g. via informal rent, use other family members’ land plots, etc.). So far, the average size of actual land in use is 19,07 Ha compared to the official database average land size of 15,85 Ha.

In addition, about 58% of interviewed farmers have investment plans. The greatest share of farmers (60%) envisages investing in land purchase, 27% - in machinery and equipment, and above 9% in improving building infrastructure.

“The top 5 crops produced by family farms are wheat, barley, corn, sunflower, and soy. Sunflower and barley demand less watering, and thus are more prevalent in the Southern regions while soy is more popular in the Western regions and corn prevails in the North-Central regions”, added Mr. Felske and at the same time reiterated the farmers’ need for advice and recommended to diversify away from commodities.

The Team Leader also presented the key findings of the study, and it was noted that:

- the majority of farmers want to develop their business but are not sure how;

- most family farms use their own resources to finance business activities and refrain from credit;

- most farmers understand the importance of insurance but have distrust towards insurance companies; and

- some farmers consider investing in modern technology to adapt to the effects of climate change, but their own machinery is often outdated.

Meanwhile, AFC provided the following recommendations to financial institutions on identified points on dealing with farmers, such as to:

- combine financing with business extension services and advice;

- carefully design financial products that cater to specific needs of small farmers, also taking into account lessons learnt from the current practice of lending to large agricultural companies;

- design financial products and services that specifically target climate change effects (irrigation, machinery, crop variety), and at the same time provide advice on climate adaptation; and

- according to a general opinion, smallholders in Ukraine are not insured at all thus financial institutions may offer combined products, which include (index) insurance.

The full study will be published soon; follow us on LinkedIn to learn more!